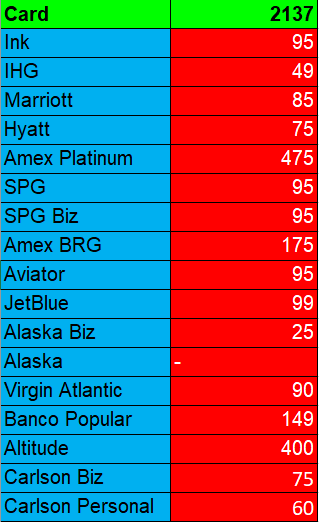

I did much better in 2017 in what I paid in annual fees and what I received in comparison to 2016. That’s because I cancelled a number of cards if there was no retention offer and because the churning rules by banks limited my credit card options/approvals. Overall, I spent $2137, but the points gained and travel credits more than offset those fees.

Note: I don’t factor in lounge access, Global Entry, Gogo passes, or other perks for weighing whether I should keep or cancel the card. For me, the math is strictly based on how much I pay in annual fees, and the points I receive as a result.

Here’s the beautiful spreadsheet of what I paid. Below, I’ll show what I got out of it.

The Bad

- Chase Ink: I only had one bad, it was the Chase Ink. I paid $95 again with no retention offer, but with 5/24 I have no choice but to pay because I use the 5X for utilities and using this card is the best way to earn URs.

The Okay

- Amex BRG: I’ll never cancel this card as BachuwaLaw uses it to pay for ads which net 3x MRs to help spread the word that I fight for consumers.

The Good

- IHG: One stay certificate which well more than offset the $49 petty fee. I will not be using it in the IC Tahiti like I did before.

- Marriott: I used the stay certificate to stay at the great AC Atocha Madrid which, at $220, made keeping this card worthwhile.

- Hyatt: As usual, I am keeping this card because of the stay certificate that I have yet to use.

- Amex Platinum, Benz Edition: Initially I was going to cancel this card. A retention call netted me 15k MRs. Along with the $200 travel credit, I came out well ahead of the $475 annual fee.

- SPG: 7,000 points for spending 1k made keeping this one a no-brainer.

- SPG Biz: I received a $125 statement credit which offset the annual fee.

- Barclays Aviator: I paid the fee when I signed up and received the sign-up bonus.

- JetBlue (again). 60,000 points for spending 1k. No gripes here.

- Alaska Biz: I was approved and received 30k for the business card. The annual fee was offset by the personal card credit.

- Virgin Atlantic: Good news! I’ve hit the 12k spend on this card and will get the 90k. I didn’t even MS! I’m not sure the lack of MS is a good thing as I spent 12k of my own money on who knows what to reach the min.

- Banco Popular: I received the 60k LifeMiles which was the good news. The bad news is redeeming them has been a pain as the system perpetually crashes.

- US Bank Altitude: $325 in travel credits, Gogo passes, and 50k in points made this card worth getting. I’m not sure it’s worth keeping as the travel credits only hit after you pay the annual fee.

- Club Carlsons: 80,000 points to pay the annual fee for these two cards was easy to rationalize especially after redeeming them at the Radisson Barbados.

The Stupid

- Alaska Airlines Platinum Plus: I thought I was going to receive the 30k bonus. I received 5k instead because I wasn’t approved for the Signature version. At the time I applied, I boasted about ‘being back‘ in the points game. What a fool I was for not knowing that a peasant version of the card existed, and what a fool I was for not discovering that the anticipated bonus did not post.

Carlson Biz is $60 and personal is $75, no?

I believe you are right. But, I’m not making the spreadsheet again lol.