The real time blogging begins with a review of the Delta Sky Club MSP. Per usual, I’m in the back of a Delta flight on my way back to New York City.

With only one hour to make my connection, I had just enough time for a quick stop at the Delta Sky Club MSP which is currently under construction. I understand that MSP is a Delta hub so there are a lot of Delta elites and Amex Platinum cardholders that need a lounge to rest and relax. Having just one functional lounge in the entire airport would make the other Delta lounge even more crowded. Having said that, I am ready for this lounge to be renovated. In its present state, it is a glorified bus station.

There’s self-serve coffee and water out like a construction site, a trough of snacks that are unappetizing, and a liquor selection that makes sobriety seem wortwhile.

Not one to pass on a drink, I made myself a fancy Bloody Mary, utilizing the ingredients at my disposal. This included Stoli vodka, quite possibly the worst pre-mix, and an ample amount of green olives. As I poured my mix from one glass to another and back again, a few people gathered around to watch what I was doing. If you thought taking photos of a lounge was awkward, imagine receiving drink requests when you’re not on the clock.

Despite my best efforts, the Bloody Mary was not very good. I took a few sips and tossed it.

Now I’m off to New York.

Delta Sky Club MSP: A Bloody Mary Under Construction

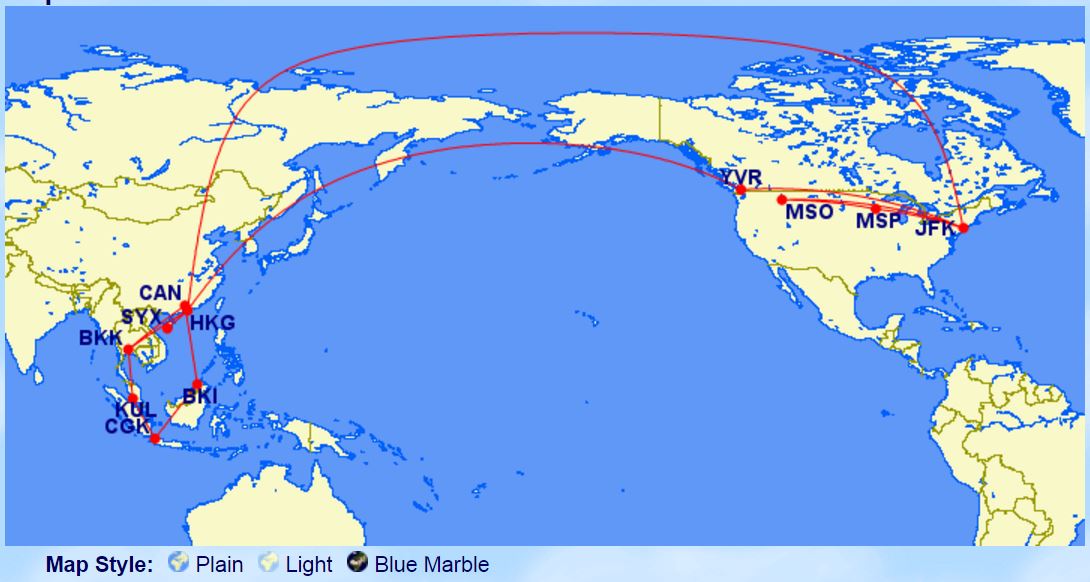

The 28,674 Mile Trip In [Mostly] Premium Is Underway!

- New York, New York

- Bangkok, Thailand

- Kuala Lumpur, Malaysia

- Jakarta, Indonesia

- Kota Kinabalu, Indonesia

- Guangzhou, China

- Hong Kong

- Shenzhen, China

- Sanya, China

TPOL 2.5 has officially launched. The website looks the same but my approach is different. I will be writing this trip report in real-time instead of pretending I will write one when I return. Some may say, go on vacation, enjoy yourself, forget the blog. I disagree. I think I will be able to savor more of my vacation if I take timeout to write posts on the go. And ‘on the go’ is where I am going. Checkout the Great Circle Mapper which has me crisscrossing Asia for no particular reason for a total distance flown of 28,674 miles.

I will try to pay attention to grammar and keep the posts substantive but sometimes I observe something and I want to share a quick recap. Inevitably, that gets a ‘this post was such a waste of my time’ response. This begs the question, “Isn’t it easier to just click onto the next post than to waste your time writing a comment?”

I hope you enjoy my new way of doing things. Let’s see how it goes.

I will try to pay attention to grammar and keep the posts substantive but sometimes I observe something and I want to share a quick recap. Inevitably, that gets a ‘this post was such a waste of my time’ response. This begs the question, “Isn’t it easier to just click onto the next post than to waste your time writing a comment?”

I hope you enjoy my new way of doing things. Let’s see how it goes.

Alaska Airlines Approved! We’re Back

Before the Festivus offenders of 2015 & 2016, it used to be so easy to sit at home and churn. It was even easier to hit the mins using the RedBird. After that gravy train was crushed by atherrosclerosis many of us retired from MS and tried to get our lives together. To MSers who continue to spend their weekends at Walmart instead of in front of a warm fire, I applaud your efforts to gather millions of points doing what you do. It’s not that the rest of us are against free trips and cash back, it’s that we weigh the opportunity cost of jumping through hoops versus making do with what we have.

And what I have this weekend is nothing short of a Christmas miracle: 4 Applications: 2 instant approvals (Aviator & LifeMiles) and now another approval for the Alaska personal. Even if I am not approved for the Alaska business, I am sitting pretty for 2017 and 2018 for points travel. Sure I don’t have an 8 figure balance, but I also don’t have to worry about the points police coming to take me away. If they come knocking on your door, be sure to call Bachuwa Law, your bank shutdown legal specialist.

LifeMiles Avianca Vuela Visa: Churning Into The Night

Deep in the night I’m looking for some fun Deep in the night I’m looking for some love Deep in the night I’m looking for some fun Deep in the night I’m looking for some…

Cards to churn.

I don’t know how you chose to spend your Friday night but I spent mine hitting the churn pipe. It started off with a Barclays AA Aviator app and approval which was followed by an Alaska personal and business pending result. On tilt, I went to OMAAT’s Best Credit Card Offers (TPOL is too poor to have credit card affiliate links, support him in other ways) and scanned the list. At the very bottom there was an offer for the LifeMiles card which apparently gives 60k LifeMiles using the promo code AVSPWE at the time of application. I had this card with US Bank and used the points to fly business class on SQ from Shanghai to Bali. I know that US Bank is tough as nails when it comes to credit card approvals which is why I was happy to discover that it’s actually a foreign bank that provides the card. After many security questions, I was approved and should receive my card and the $149 annual fee in the coming weeks.

Without MS, my balances were getting a little shaky. With these two cards, I think I can pull off a few more trips before getting anxious again.

Barclays Aviator Approved! Damn I Missed The Churn Life

My friend sent me a message saying that he had been approved for the Barclays AA Aviator card, something that I had waited for following Citi’s elimination of my AA points party. The offer is 40k AA points after your first purchase. I like how Barclays doesn’t bother with minimum spends that many meet by treating their hypochondria with daily visits to the Wheel of Fortune Puzzle that consists of three letters. Instead, Barclays charges the annual fee up front and that’s that. Interestingly enough, I have yet to encounter a client with a consumer arbitration claim against Barclays. That’s probably because they don’t bother with the ambiguous language that many banks like to enforce when it is to its convenience.

Anyhow, his instant approval had me jealous and nostalgic so I pulled the trigger and was surprisingly approved. Take that Festivus 2016 offenders! Giddy, I tried for an Alaska card and it was deja vu all over again as I got the pending result. Will I get another definitive no from Alaska?

Seeing Double: A Great SPG, Marriott, Ritz Points Promotion

The SPG Marriott merger continues to surprise me, in a good way. As a devout SPG Platinum, I was scared that my Aloft Bangkok would be taken away from me via a merger devaluation. Instead, I am finding new ways to redeem my points by transferring them to and from my SPG account.

Today, I signed up for the new double-points promotion whereby I can get double points for my first three stays at SPG, Marriott, and Ritz hotels respectively. The double promotion provides incentive for me to step out of my SPG comfort zone and stay at more hotels like the Marriott Grand Cayman. It also makes me more open to transferring my SPG points to my Marriott account. A 1 to 3 SPG-Marriott conversion rate stacked with this double points promotion is a great way to celebrate an open border policy.

In order to qualify for this promotion, you have to register each of your SPG, Marriott, and Ritz accounts separately. Stays must occur between January 16, 2017 and March 15, 2017. All the details can be found here.

Where are you going to double your pleasure?

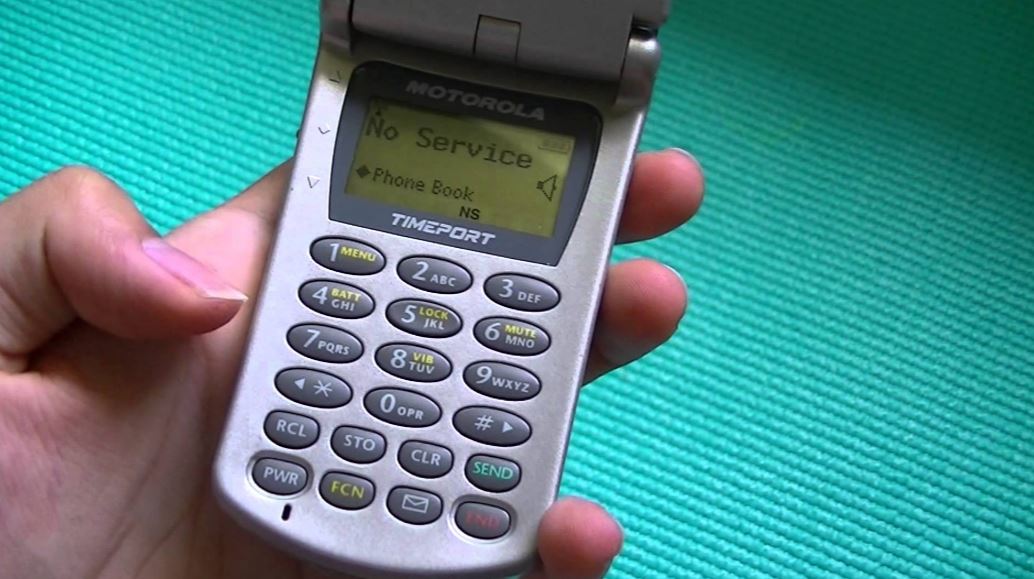

Breaking News: Samsung Galaxy Note 7 Will No Longer Work Come January

As a consumer arbitration lawyer, I deal with major wireless companies and clients that are frustrated with some or all aspects of their service. Weeks ago, I wrote about the airline ban on Note 7 and the impossible task of trying to police who comes on a plane with one. Well, the job will get infinitely easier for the crew as a representative at a wireless company informed me that the carrier will no longer support service on the Note 7 effective January. That’s the smartest way a carrier can do its part to get these firetraps off of the market. It is also another embarrassing development for Samsung which has lost billions from this battery fiasco.

If you have a Samsung Note 7 and can’t be bothered to do the voluntary recall or if your wireless provider is being difficult about it despite the recall, know that in January the phone will be even more useless.

Personally, I use the S7 Edge and despite losing it twice, think it’s the best phone since my Motorola Timeport.

If you or someone you can tolerate is having an issue with your wireless provider, contact me at bachuwalaw.com.

Editorial Correction: In a previous publication, I called it the S7 Note. It’s the Samsung Galaxy Note 7. Who can keep up with all these names? Bottom line it’s the Note that catches on fire.

Bill Pay Sunday! Help TPOL Help You

I need money! Maybe it’s better to say I want money. For years I’ve been blogging for the love of blogging and to get the effervescent reaction from trolls. Apart from the ads provided by BoardingArea and the creditcards.com ad you see to your right that tell you which card is perfect for you this holiday season even if you have been rejected from the Chase Sapphire Reserve, my site is not ad centric. Besides begging for SPG referrals, I haven’t utilized the power of digital marketing. It’s not that I am against ads or all the ways bloggers make money, it’s just that I’m too damn lazy. This indifference makes no sense because many of the products I endorse have affiliate links. Why not get some cashback for boasting about how great a Blackberry is?

Starting Sunday, I’m going to write the same posts that I always do in my Travel Widgets section only from now I’ll have to disclose that I am having a financial love affair with that company which is based on reader purchases through my site’s portal. (Side note to bloggers: Using legal mumbo jumbo and putting your financial disclaimer does not make it anymore compliant than the disclosure I just provided.)

Bill Pay Sunday starts next week because I need a dollar…

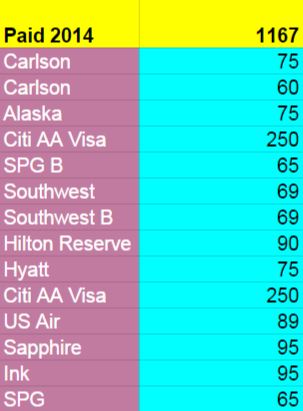

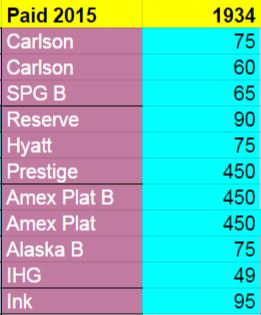

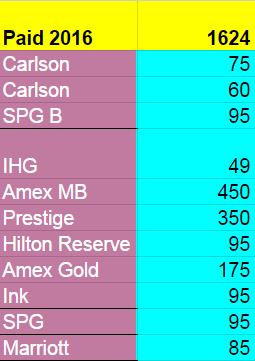

2016: What I Spent (And Received) in Annual Fees

Another year has gone by and more fees have been paid. For the most part, I did just fine in maximizing the value of the annual fees but not as well as I did last year. I’m slipping on my frugality by rationalizing keeping cards open that should be closed.

For sake of nostalgia, let’s start with 2014 when the points game was a lot more appealing.

Not all the cards made the cut for 2016.

Not all the cards made the cut for 2016.

- Keep Vs. Cancel: IHG, British, Alaska, Amex Platinum

- Keep Vs. Cancel: Amex Business Platinum

- Keep Vs. Cancel: Citi No ThankYou

- Keep Vs. Cancel: SPG Business Card

- Keep Vs. Cancel: Chase 2016

- Keep Vs. Cancel: Citi Prestige

The Ugly

Citi Prestige (-$100, Bad Deal): I had the Citi Gold Checking account which I closed after bungling the choice of what bonus to take, AA or TY. I ended with neither. The checking account reduced the annual fee for the card from $450 to $350. I spent $250 on travel and held onto the card in the hopes of playing three free rounds of golf, a perk that is going away in 2017. In the end, I didn’t book any rounds of golf. I did visit a few AA lounges including the Admirals Club MIA and Admirals Club JFK but I do not use that in calculating whether the card is worth keeping. I am going to book some random golf rounds for next year and see if I can make back the $100 I lost by keeping this card.The Bad

Chase Ink (-$95, No Choice): I kept my Chase Ink because Chase won’t let me downgrade and I enjoy the category spend for utilities and office spend. If I had a desire to come out of MS retirement, this card would be invaluable. With the 5/24 rule, I have been bullied into keeping this card and paying the fee. Marriott (-$85, Decent Redemption): The Marriott comes with an $85 annual fee that is not waived the first year. I stayed at the Marriott Grand Cayman for two nights and still came out ahead despite the resort fee.The Recons

SPG Business (-$95, Necessity): I received 3K SPG points which made keeping this card a no brainer. The card also gave me 2 nights stay to requalify for platinum. SPG Personal (-$95, Necessity): The annual fee is due this month. I will try recon again. I will keep the card regardless of the outcome because I received 20k SPG points in referrals, though it took an eternity for them to post. Anyone looking to apply for this or the business card, do let me know!The Business

Amex BRG ($175, Time Will Tell): I paid the annual fee on the Amex BRG in the hopes that I will make up the $175 annual fee by way of category spend. Besides blogging, I run a digital ad agency, crushinIT, where I specialize in helping start-ups, attorneys, and other professionals grow their business. The ad spend counts as 3X. (For those interested in expert services, I do not charge a monthly fee or ridiculous setup fee. It’s all on contingency.)The Good

Hilton Reserve (-$95, Easy Does It): I’ve been terrible at redeeming these stay certificates effectively but I will certainly be able to get my money’s worth by staying somewhere decent for two weekend nights. Club Carlsons (-$135) Along with the Office of the President certs, the annual bonus for these cards made them worth keeping. I stayed at great properties in St. Petersburg, Russia, part of my Quest Around The Globe Trip which cost far more than the annual fees.The Best

IHG (-$49, Too Easy): In my upcoming Year of the Monkey Trip, I am visiting Hong Kong and staying one night at the InterContinental Hong Kong which goes for $350 a night. Enough said.The Bestest

Amex MB (-$475, Worth It!): For 100k points, $200 in airline credits, Centurion Lounge access which I used in Houston, Vegas, Miami, LGA. Those along with access to Delta SkyClubs all over made the Amex MB an easy swap from the Amex Platinum which has the same benefits minus the Benz logo.Overall

TPOL done good with the annual fees. It wasn’t as great as last year or the year before but in today’s points economy, I’ll take it.Happy Festivus! Airing of Points Grievances 2016

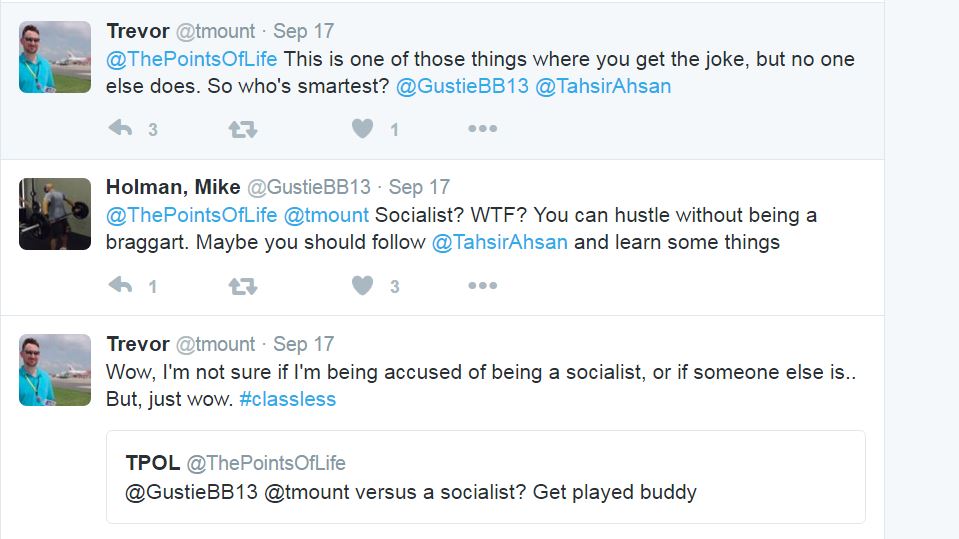

Happy Festivus! Festivus 2016 is just as cathartic as it was in 2015. It’s been a good year for TPOL but let me tell you all the ways that airlines, hotel chains, credit card companies, bloggers, and commentators have disappointed me over the last year. This year I’ve added a special section highlighting the very best from trolls on Twitter.

The Banks

The Definitive No from BOA Alaska I Thought My Alaska Card Was Cancelled! Approved for a Chase Sapphire? Why That’s A Bad Thing How Do You Handle Rejection? Another CSR Story Stiffed Citi AA Exec Bonus Points: Arbitration Right Away?Peaceful Resolution For My Denied Citi AA Exec Bonus

SPG Refer A Friend: Bonus Paid…9 Months Later Was I Discriminated Against By US Bank? The Peaceful Conclusion: US Bank Follows UpThe Hotels

Hyatt Kills Gold Passport The Hyatt DSU Aftermath Grand Hyatt DC And My Unintended $80 Wine Bill M Life Customer Service: Like Searching for a Casino Exit No AC in Tahiti! Club Carlson E-Certs: Good Luck Booking!The Airlines

Captain Obvious: No Domestic Routing Changes Post AA Deval AA Ticket: Y’all Got Drama, The Saga Continues Thai Airways from Tahiti: Giveith, Takeith, So I Quitith Etihad Cancels My Apartment, AA Doesn’t Care HKG-BKK: AA Bumps Me Down to Business JetBlue Flight Cancelled: Rebooked a Day Later? SQ Reclaims KrisFlyer Miles United Kills Points Travel When Flight Reservations Disappear Dear Delta: Why You Gotta Be So Rude? Aegean Air Bait & Switch: Any Recs? British Avios Trickeration: No Online S7 Booking, No Cathay, No DragonThe Trolls

The Feats of Strengths

I have found the best way to solve many of these problems is by using my law degree. Here are the ways I have helped members of the points community fight back against bank shutdowns, fraudulent purchases, and crappy customer service in small claims, class actions, and arbitration.The Fine Print: The Successful Fight Against A Citi Shutdown

The Fine Print: The Results Are In!

The Fine Print: Thou Shalt Not Manufacture Spend

The Fine Print: Who’s To Blame…eBay, PayPal, or Hyatt?

The Fine Print: Dynamic Currency Conversion – A Euphemism for Highway Robbery

The Fine Print: Should You Record Your Calls for Quality Assurance?

The Fine Print: Consumer Arbitration — an unfamiliar weapon for battling corporate mischief

![The 28,674 Mile Trip In [Mostly] Premium Is Underway! The 28,674 Mile Trip In [Mostly] Premium Is Underway!](https://thepointsoflife.boardingarea.com/wp-content/uploads/2016/12/1-1-768x410.jpg)