Mr. Churner,

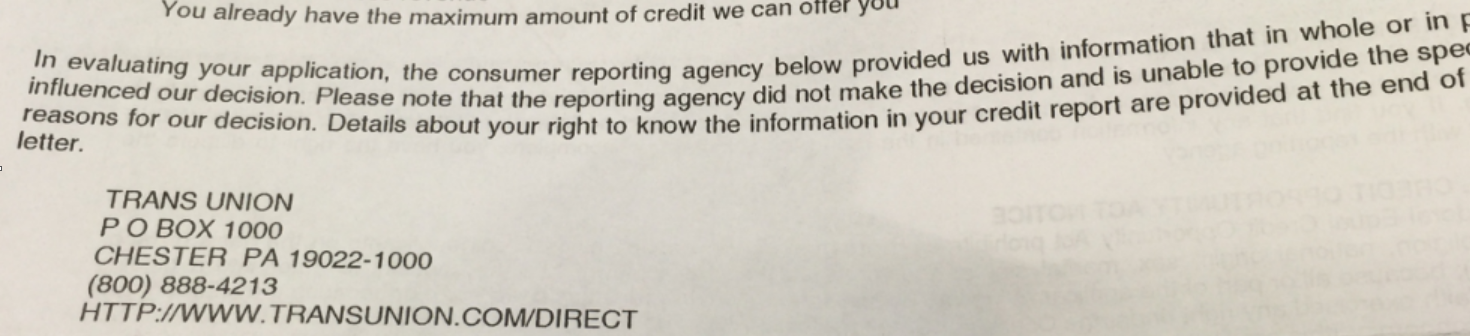

We regret to inform you that we could not approve you for your 9th card in 9 months.

Sound familiar?

If you are a card churner or manufactured spender I’m sure you’ve received this notification before and despite calling the reconsideration line 9 times, your Herman Cain 9 9 9 plan did not yield you yet another points card leaving you a few points short of a second dream vacation to the Maldives.

Can anything be done?

According to my takeaway from the Reuter’s article, U.S. banks ramp up credit card lending but margins may suffer, the answer is yes.

The article states that, “JPMorgan Chase & Co, Citigroup Inc and other big banks are making more credit card loans, after years of focusing mainly on customers who paid off their balances each month.”

“‘A lot of companies are getting back to marketing their products aggressively,’ said Eileen Serra, chief executive for cards at JPMorgan.'”

“Banks cut back on advertising, mailings, and rewards programs during the financial crisis, when losses jumped. But the market is now increasing again.”

The ramifications of this development is three fold:

1. The points game is far from dead. Companies are fighting harder than ever to attract new customers and retain old ones. The article reports, “Almost all of the most creditworthy customers already hold cards that pay rewards. At this point banks are in . . . an ‘arms race’ to make their rewards programs attractive enough to lure customers from other banks and to keep the ones who have already signed on.”

Can you say 100k mega offer?

2. For those that follow the 30 Steps to Maldives: Step 1, you will likely have more leeway in applying for that 10th Alaskan Airlines card to fly Emirates since you pay your balance off in full every month. Per the article, “In the years after the financial crisis, banks focused on credit card customers who were big spenders, charging upwards of $15,000 a year on their cards, but who also generally pay down their balances in full every month.”

3. For those newbies or for those hooked to churning, it’s time to break out that Excel spreadsheet and forecast if you really can afford to apply for another round of cards. Referencing the article, “Banks are all looking for the holy grail: consumers who spend a lot, and will carry a balance from time to time, including all the interest rate charges that often run to a rate of 15 percent or more.”

While we all love the free travel perks from using our credit cards, we must be extra vigil of the financial prison of high interest rates, the false hope of balance transfer offers, and the crippling minimum payments of 0% promotions that make another $500 charge for a seaplane to the Conrad Maldives a bad idea, regardless of any cashback promotion.

Churn safely my friends.