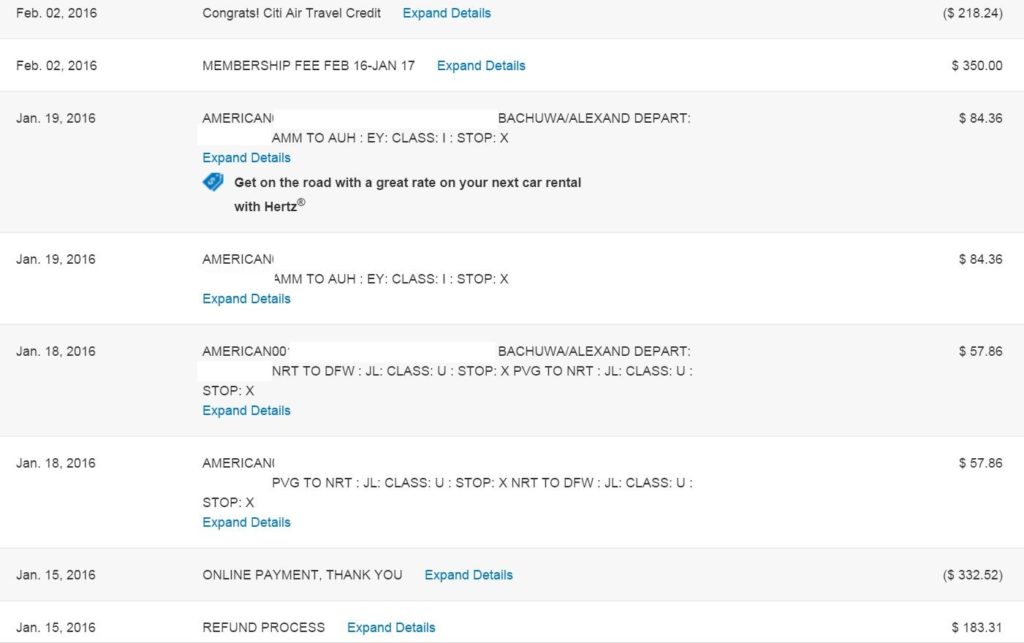

What’s this, a prorated refund for my Citi Prestige card? Don’t ask questions, just be happy.

What’s this, the annual fee has been reapplied? Those bastards.

What’s this, it’s down to $350? Thank you Citi Gold Checking and no thank you at the same time.

I opened a Citi Gold Checking account in January and funded it with my Alaska card which netted me 32,000 Alaska points. I’m still waiting for the 50k ThankYou points to post before doing a full write-up on that transaction. A couple of weeks after opening the checking account, I noticed a prorated refund on my annual fee for my Citi Prestige card which I transferred to my checking account. I assumed that the refund was a result of opening the Citi Gold account.

On my February billing statement a new annual fee of $350 was applied which is the discounted rate for the Prestige given to Gold checking account holders instead of the usual $450.

Now I’m wondering if I should keep or cancel the card because I did not forecast having to pay the annual fee until April when I originally signed up. I’ve used up the $250 travel statement credit but have not utilized the rounds of golf for 2016. I could speculatively book 3 rounds and then cancel the card within the time allowed to get a refund for the annual fee.

Had I not cashed out the prorated reimbursement and had I been billed the $350 in April, I would have more time to both decide if I wanted to keep vs cancel and would have more time to plan my rounds of golf. Now it seems like I should cancel because I essentially have profited from having the card by maximizing all the benefits.

What to do? First, I’ll call Citi.

Quick, somewhat unrelated question…when you funded with your Alaska card was it treated as an advance or as a purchase…I’ve heard both

At the very least you could’ve helped me with your thoughts on my problem first!

Definitely not a cash advance. I reduced my BOA card to $200 cash advance limit. Also, Doctor of Credit has a more extensive discussion about which banks treat it as a cash advance. For example, Chase does.

http://bit.ly/20a1La3

Had the exact same thing happen to me. I called Citi for an explanation. They said it was prorated, I told them I did not want that and would rather they leave the AF cycle the way it was (I was going to cancel before it was due). They said they couldn’t reverse the charges and I told them I was extremely upset and this was not conveyed to me in prior to opening a CitiGold account. At the end of the call, they just credited me the new $350 AF charge. So I’ve had the Citi Prestige since May and have not been charged the AF.

I do plan on cancelling the CitiGold once the bonus miles post so I’m wondering if they’ll charge me the AF in May when it was originally due or December to sync it with when I opened the CitiGold account.

This is very helpful. Thank you for sharing. I’m going to call Citi now with new confidence. I agree it totally throws everything off.

I honestly would keep the card but the wife says no more than one card with a high AF at time and I want the Amex Platinum.

2015 was the year of annual fees and I made it count: http://thepointsoflife.boardingarea.com/2015-what-i-spent-and-received-in-annual-fees/

2016 is the year of redeeming points not being tricked by perks. The one perk everyone raves about is the 4th night free which I’ve only used once which could offset the annual fee. The golf is the other. But these were supposed to be decisions made in May…on hold with Citi now

No luck for annual fee

YMMV I guess.

I hate ymmv and imop and smileys. But yeah I spent an hour on the phone for a crap retention offer. Maybe I should’ve huca winkey smiley lol.

That’s be being jealous of you.

LOL Haters gonna hate.

Did you open your Citigold online or did you go to the branch?

Online