Is credit card churning easier now? I believe so.

I’m not talking about the reconsideration line calls where you have to explain why having a third Ink is necessary for the vitality of your blooming twitter handle business @myinkcard. Those calls, like job apps, never get any easier when they end in rejection.

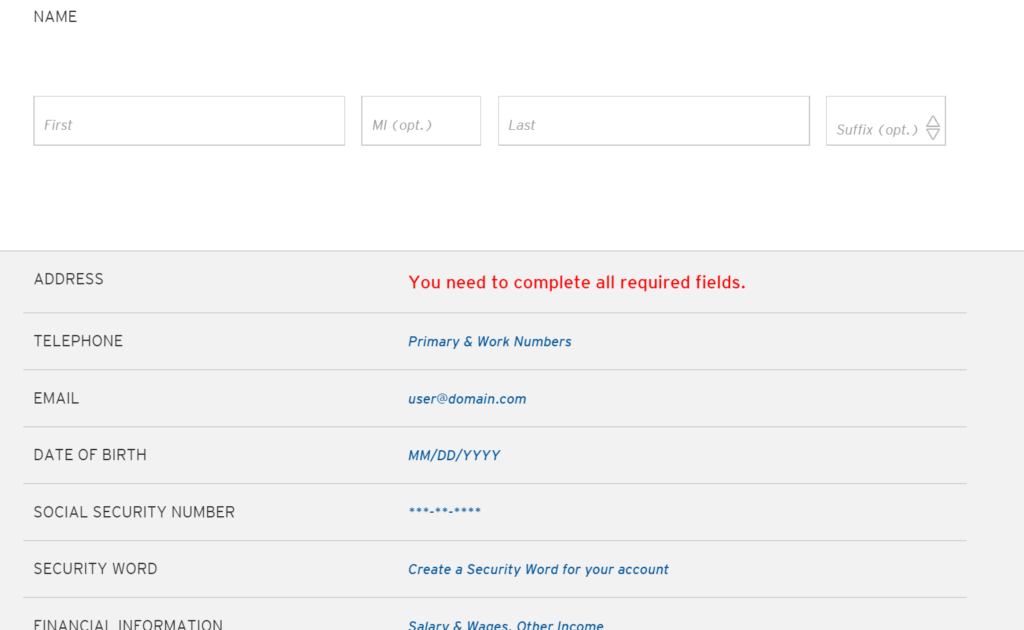

I’m speaking about the flurry of going from one app to the next and filling in the information with minimal effort. Case in point: the Citi online application.

Long gone are the days of out of order boxes, overbearing questions, and cumbersome forms. Now, with only a few clicks and minimal character strokes, the range of emotions of your app being processed right in front of your eyes is mere moments away. For me it goes like this:

1. I can handle the rejection.

2. I’ve got enough free points, I deserve a rejection.

3. Come on baby!

4. No recon, no recon, no recon….stop!

5. Yes!

4a. No recon, no recon, no recon….stop!

5b. Damn it, recon whammy!

Rejection, acceptance, or recon purgatory, I postulate that the credit card companies want us to churn. Why else are they making the process more fun and easier than ever before?