A common misconception is that the points hustle means free travel. What is overlooked is the hidden costs from manufactured spending, the cash from the cash n points, the rip-off of taxis, and the cost of enjoying yourself when you are there.

I rationalize that most of these costs are acceptable because I receive so much for spending so little. (see Emirates Shower Class to Tahiti as en example.)

Still, only a fool in this business wouldn’t keep track of what he spends, believing that one Cathay flight in first would make all of the spending worthwhile. With the end of the year fast approaching, I decided to do an audit on my 2015 annual fees to see where I stand.

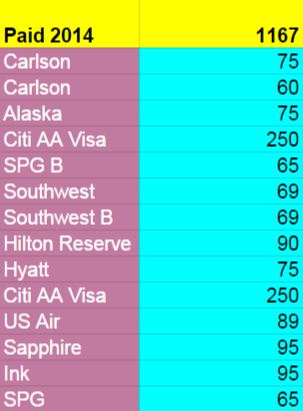

First, let’s take a look at what I spent last year:

That was a mighty collection of cards in 2014 but alas I had to cancel a few when the annual fee was due.

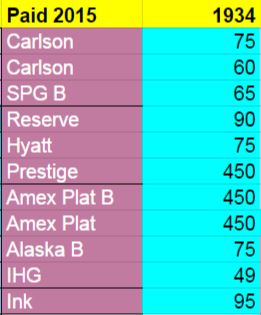

Here’s the spending for 2015:

This year I’ve spent plenty on annual fees and I’m still on the fence as to whether I’ll cancel the SPG personal which is due in eight days. That $95 would put me over the $2000 mark. Taken on its own, that sounds outrageous.

It would be foolish to say that the sum of my annual fee netted me hundreds of thousands of points making the annual fees automatically worth it. Points devalue faster than we can keep up so that shiny balance means nothing if it is not used. (see Shut Up & Book Valuation of Points) It would be short-sighted to list all the benefits that the cards provide if I did not make use of them.

So let’s take each card one at a time and see if it was worth paying the annual fee.

Club Carlsons: It’s been a tough year for Club Carlson cardholders. The devaluation ruined the party which is why many cancelled their cards. I stuck around because of the two night stay certificates given to me by the Office of the President. Though I haven’t booked anything with them yet because of their silly restrictions, I know I will make use of them and recoup more than the value of the annual fee.

SPG Business: 2 stays towards requalifying for Platinum was worth the $65. Next year’s fee will be $95. That’s not fun.

Hilton Reserve: I MS’d 10k to get a weekend certificate. It has an expiration date so I know I will use it before it expires making the card worth it.

Hyatt: I used the Hyatt Category 4 certificate to stay at the Park Hyatt Toronto. That was more than $75 so it was worth it even if the hotel wasn’t great.

Prestige: $250 of the $450 went towards airline credit during the Hyatt Diamond Challenge. 31,000 of the 50,000 bonus points were transferred to Virgin Atlantic which I used to fly Upper Class to LHR. I also have had one free round of golf in Carlsbad, California which retailed at $175 and will book another before the year is up. Totally crushed the annual fee on this one.

Alaska: I spent $1000 on my Alaska personals to receive a $100 statement credit, thereby negating the annual fees for the 3 personal ones I had. The $75 fee for the business card did not have this offer but the statement credit of the others along with a booking on Emirates Shower Class sort of made it worth it.

IHG: Things keep rolling with the IHG card which gives a one night stay certificate annually. I applied it the best way possible; I booked one night at the InterContinental Bora Bora.

Ink: $95 was not waived and I could not downgrade to a no annual fee version of the card. Chase got me on this one but I think that the 3x on utilities monthly bonus offsets the cost. Still, this is an example of gaining points with no direct result, something that I do not advocate.

Amex Platinums: I used the statement credits of $200 each for airlines related purchases so the true annual fee is $500. I plan on redeeming an additional $200 next year for the business card before the annual fee becomes due so that drops the cost down to $100. What did I get for $100? I went to the Amex Centurion Lounge in Mexico City, the Delta Sky Club in Minneapolis, Detroit, and Salt Lake. I value this at $0 because if I didn’t have the card I would have just sat in the terminal uncomfortably and thought nothing of it.

I did book my exodus flight out of Montana to New York for only 12,500 Delta points which is nothing. The price of that ticket because it originates from one of the smallest airports is usually $300. Say that Delta points are worth 1 penny, this means I saved $175. This completely negates the annual fee. But let’s not forget the bonus I received from reaching the mins on these cards. (100k for the Platinum and 150k for the Business Platinum along with the 75k from the BRG) That’s a boat load of points. I know I said the big balance is nothing to be proud of as it is irrelevant until it is used, but I’ll make an exception in this case.

Overall, 2015 was a tough year for the churners of America but when you break it down card by card, I still came out way ahead.

On the Ink card, you may have gotten no direct result, but those points are pretty damn versatile. You’ll get some good use out of them. What’s next? Gonna try for a Fairmont card while possible?

Yeah but most people are still earning the 3X on utilities but not paying the annual fee.

I’m going to do nothing until next year. It’s been an exhausting overkill this year.

spoken like a true economist. best line of the post: “I value this at $0 because if I didn’t have the card I would have just sat in the terminal uncomfortably and thought nothing of it.”

I thought you’d appreciate that.