Points nerds love these posts because it’s a chance to compare what cards are in my wallet versus what ones are in yours.

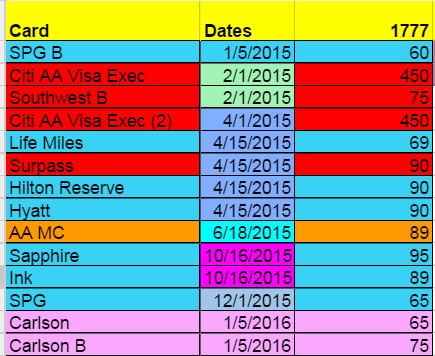

I use Excel to keep track of all my annual fees and to track which cards I’m going to dump verses which cards I’m going to keep.

Here’s what I paid last year: A total of $1167 which looks like a lot but the amount of points yielded made it well worth it.

Who didn’t make the cut for 2015?

Barclay’s Arrival: While there are plenty of opportunities to use this card for MS, the $89 fee wasn’t worth it because my focus is more on points and less on cash back.

Southwest Personal: Might as well use Chase Sapphire to get the points that are transferable to Southwest instead of paying the annual fee. I’ll cancel the Southwest Business (in red above) hopefully by applying for another Chase business card and transferring the credit line.

Alaska Airlines: Over the last year and a half I’ve cancelled all 3 Alaska cards because I already took my Emirates flight and now it’s time to rechurn.

US Airways: How many of these have I had? I’m not even sure but I cancelled them all in a last-ditch effort to apply one more time before US Airways goes bye-bye.

Who’s going to get cut in 2015? Everyone in Red:

I don’t proactively cut cards until the annual fee hits my account and I call to cancel the card to see what offer I may or may not get. Bank of America (Alaska Airlines) hardly ever gives offers and makes it near impossible to shift the credit line.

American Airlines Executive Card: $450 annual fee? Cut. And cut again.

American Airlines Master Card: This is in orange because every time I try to cut this card, Citi waves the annual fee. Also, it may be worth keeping because it does provide a rebate of 10% miles spent each year which probably will justify the fee as most of my points are now with American/US Airways.

Hilton Surpass: American Express still hasn’t given me the sign up bonus of 75k. All I’ve received is the 60k offer despite calling them over and over. The card is useless due to Hilton devaluation and the gold status that comes from the Hilton Reserve card.

So who’s left over? The usual suspects:

SPG Personal and Business: Cheap annual fee, needed to requalify for platinum.

Hilton Reserve: Gold status which is as good as diamond for Hilton. Also, can get one free weekend night with MS of 10k.

Hyatt: Free night by paying annual fee. Last year, I used it to stay in the Hyatt in Costa Rica. Includes platinum status but platinum is for peasants compared to Hilton Gold and SPG Platinum. Hopefully this year I can figure out how to go back to Diamond. MS gets you closer but not nearly all the way there if you use this card.

Sapphire/Ink: The go to cards for everyday spending and utility bills. I make a feeble attempt to get some sort of credit for the annual fee but give in when they say no because these are still the best.

Club Carlson Personal and Business: 40k per card for paying annual fee which if you MS a little can reach 50k per card, good for 2 nights in just about any Club Carlson property.

LifeMiles Card (US Bank): The most overlooked card in the points directory for a few reasons:

- Nobody likes to deal with Avianca’s customer service when booking flights.

- All segments of a rewards flight must be flown in the same cabin.

- Devaluations always occur.

- Hard to get approved by US Bank if you’re a churner.

But if you can brave 1-4 and you can MS on this card it is well worth it because LifeMiles lets you book flights cash and points using Star Alliance members like Singapore Airlines. Last year I flew from Shanghai to Bali in SQ business for 20,000 points and $200 dollars.

Cards with No Annual Fees

I have a few of these as well which may help with MS. Those include Discover and Chase Freedom. I even have a BMW card which gives points towards maintenance but I no longer own a BMW. Still I keep these cards open to preserve a high credit score.