Disclaimer: The following is not legal advice. Please contact me at bachuwalaw.com if the following happened to you.

I was away on my South America & Africa Points Heist trip. When I returned, I only had a few pieces of mail because everything else is delivered electronically. One was from Chase which said that after careful review, they decided not to close my Chase Sapphire plastic, not titanium, account. That’s odd since it’s usually the other way around.

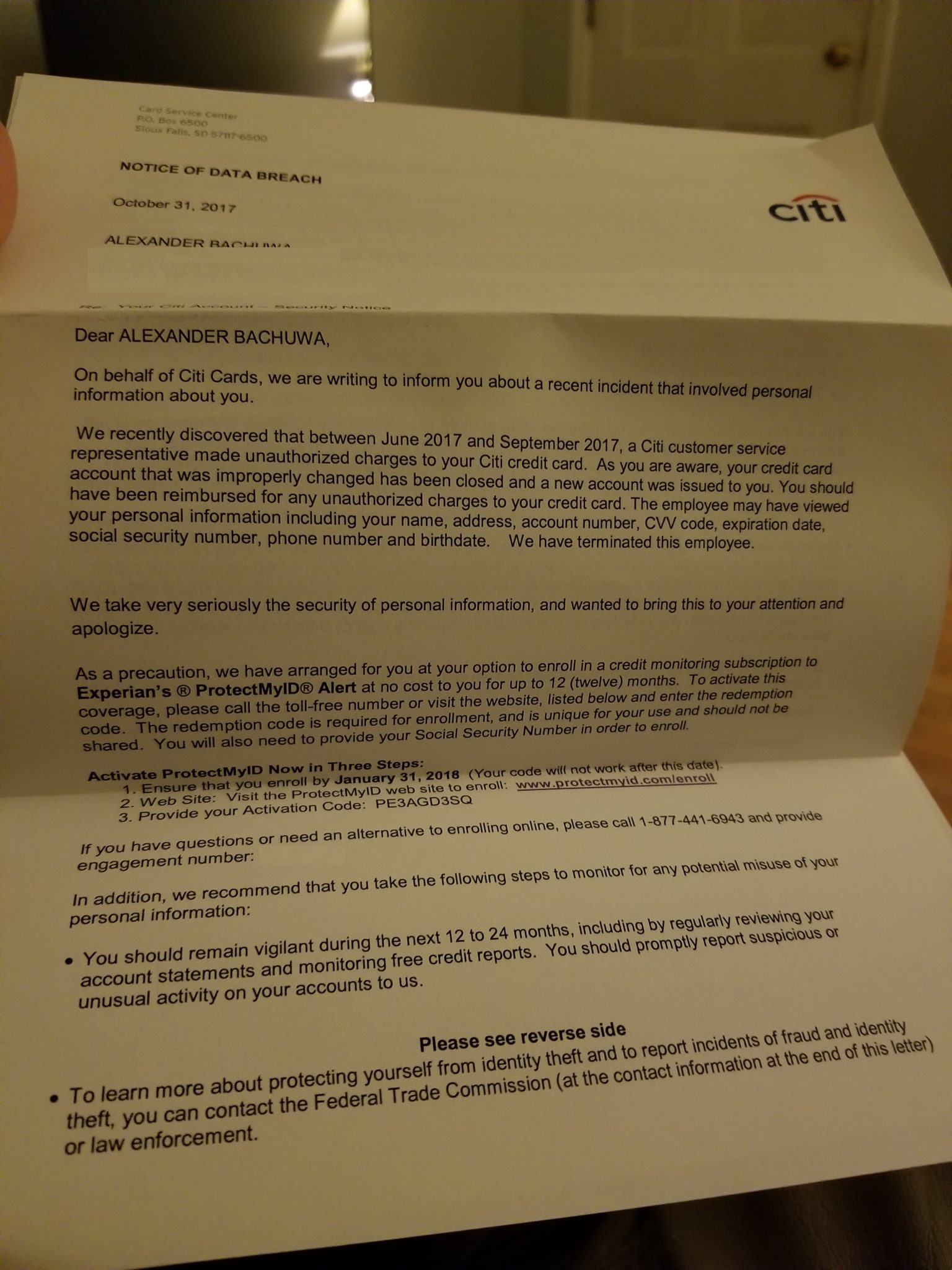

The second letter was way more surprising. Here it is:

I read it over and over and didn’t know what to make of it. First, I thought it was fake and had to check the envelope that it came in. Then, I tried to figure out which account was compromised because the letter did not provide the account number. The oddness didn’t end there. The language in the letter had me scratching my head:

- A Citi customer service representative made unauthorized charges to your Citi credit card.

- How easy was it for a Citi rep to do this? I wonder what he bought. Did I get points? Were they clawed back after the charges were reimbursed?

- The employee may have viewed your personal information including your name, address, account number, CVV code, expiration date, social security number, phone number, and birthdate.

- Now, I am no longer laughing. How the duck could an employee see so much stuff so easily?

- We have terminated this employee.

- Back to light-heartedness: Did I call in and piss someone off and they did this as revenge? The way the letter reads, it seems like this was one employee and one account, but I have since learned that other people have received this letter.

- As a precaution, we have arranged for you at your option to enroll in a credit monitoring subscription, free for one year.

- Equifax part 2? How is one year of protection going to help me? This is similar to why my firm is filing arbitrations against Equifax. What happens in year 2, 3, 30?

- You should remain vigilant during the next 12-24 months, including by regularly reviewing your account statements and monitoring free credit reports.

- Remain vigilant? Is the guy going to show up at my house in addition to stealing my identity? Why would you only offer free credit protection for one year and then tell me to remain vigilant beyond that?

Overall

This is a huge deal for many reasons. I trust Citi with my personal information and cannot believe how easy it was for an employee to gain complete access to my account. Unlike Equifax, it has not been publicized so I’m not sure how many people are affected. One thing I do know is that this is just the beginning of the this story as I plan on filing an arbitration claim to address Citi’s gross incompetence and negligence.

How do we find out if our Citi accounts were violated? Any remedial rights?

LOL, it’s a targeted offer. If you didn’t receive a letter then you are probably fine.

Climbing in yo credit, snatchin yo info up. Hide ya cards, hide ya wife

Still the best!

HAHAHA “targeted offer”

Lol

[…] Did A Citi Employee Steal Your Personal Information Too? – This is the worst kind of identity theft because there’s nothing you could have done to prevent an inside job like this. A reminder to always stay vigilant, review your statements, and watch out for unknown charges. […]