When you’re a master churner, you may find that you have more credit cards than friends. This could be due to one of the following:

- a) You are an anti-social nerd that spends all of your time hoarding points and updating your Excel spreadsheet.

- b) You posted too many pics from flying Etihad that nobody likes you anymore.

- c) You have forty credit cards and you don’t have time for that many friends.

- d) All of the above.

If you share any of these problems with TPOL then I advise you to pay attention to this public service announcement: Check the balance of your accounts every month, even the ones that you never use.

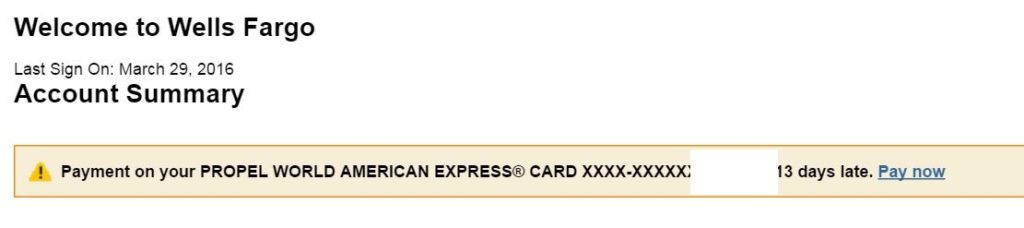

For no particular reason, I decided to check my Wells Fargo Propel Card balance, the card with the toughest approval process in the industry. To my surprise, I found that I am 13 days past due on a payment. I haven’t used this card in months so I was shocked at this news. Apparently, American Airlines charged me $98 for a flight to Los Angeles that was not properly cancelled.

Now, I have to call AA and Wells Fargo, the worst bank in the world, to straighten out this mess. As a rule, I set my due dates to the 28th for all my cards and have a fool-proof system for not missing any payments. I didn’t account for the fact that the fool in the system could be someone besides me.

Happened to me last month and i was gutted. It was only £12 but how annoying!

never paperless.

When I get new credit cards I set up automatic minimum payment. That way if I forget to check one it will auto pay the minimum due. If I pay them before the due date then they don’t auto pay anything.

I don’t understand. You make no mention of setting up autopay which IMO is the best fool proof method of not ever missing a payment. Whenever I get approved for a card setting it up to pay in full is the very first thing I do. Setting up the same due date and a spreadsheet can help, but nothing comes even close to setting up autodraft, IMO.

I don’t do auto pay. I want to know where my $ is going and I want to make sure I review the bills for accuracy. Here it would’ve paid wells $ that they aren’t entitled to and then I’d have to deal with them to get it back. This situation though annoying rarely happens and I get to maintain control. Further, you mention that you do understand why I didn’t set up autopay a if it is standard practice to do so. It isn’t and I don’t recommend it.

Autopay and reviewing the statements for accuracy have nothing to do with each other. I review all my credit card statements as soon as they close and manually tick and tie every single receipt to each transaction, and most times an unauthorized transaction posts it rarely makes it to the date the statement closes without me knowing about it. Having or not having autopay is not going to prevent you from getting unauthorized transactions on your statement and you still have to dispute them, regardless of whether you pay your statement automatically or manually. Suggesting that autopay prevents you from paying unauthorized charges is a misconception (unless you don’t take the time to review your statements). Nowhere on my OP I said it is standard practice. It is, however, my practice, and apparently a couple of other posters’ on this post. If you don’t do autopay that’s perfectly fine, but telling others you don’t recommend it is poor advice and the reason you ended up with a 13-day overdue payment on your credit card.

Good. You can do things your way and I will do things my way. It’s not ‘poor’ advice, it’s my advice.

I find it easy to make sure that I never overdraw on my checking account by not having autopay and I don’t like banks dipping their dirty fingers into my account automatically.

That’s my final response on this subject.

Autopay (and google calendar reminders for those that lack it) + Personal Capital or Mint to combine transaction history and balances of all accounts.