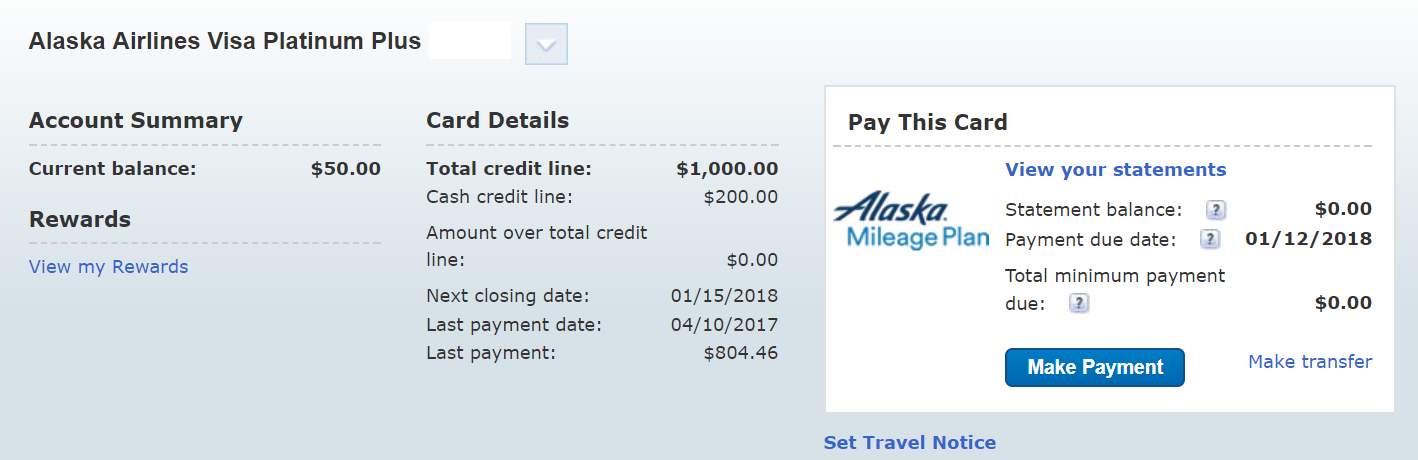

I was writing my What I Spent (And Received) in Annual Fees annual post. As part of my audit, I wanted to double-check exactly what benefit I got from each card. When I checked my Alaska Airlines statement, I did not see the 30k sign-up bonus for applying for the personal card. I opened the statements to see if I had reached the 1k spending limit. That’s when I noticed that I had a lot of returns. Did I mess up in my calculations and not hit the mins? Am I getting sloppy in my old age? After checking and rechecking that I did meet the requirement, I decided to call BoA. The agent confirmed that I hit the minimum and that I was eligible for the bonus. I jumped in and exclaimed, “But I only received 5k points!” To which she said, “You were not approved for the Visa Signature, you were approved for the Platinum Plus which only comes with a 5k bonus.” To which I retorted, “I applied for the Signature.” To which she replied, “When you apply for the Alaska Airlines card, the card you receive is based on your creditworthiness. Since you were not approved with at least a 5k spending limit, you received the Platinum Plus card which comes with the lower sign-up bonus.” To which I concluded, “Credit worthy? Months later, I was approved for the Virgin Atlantic with a healthy credit line.”

Defeated, I hung up the phone and sat alone in a corner, utterly disappointed. I couldn’t believe that at some point BoA did not think I was credit worthy. Worse, I couldn’t understand how I overlooked not receiving the 30k points. What an unforgivable versight! Finally, I was devastated because I had wasted an inquiry and received next to nothing in return. This dumb card counts against my 5/24 quota (which I am nowhere near being under) and, if it is true that BoA also now has a similar policy, will hurt my chances of being approved for a future Alaska card.

When I applied, I only had one BoA card open with an 8k line of credit, so it’s not like I was overextended credit by BoA. That was sometimes an issue when I would apply for multiple Alaska cards in one day, a strategy that was killed by MMS. The worst part of the experience is that applicants have no way of knowing ahead of time for which card they’ll be approved. Obviously, had I known it was going to be the useless Plus card, I would not have applied in the first place.

I cancelled the stupid Plus card as the annual fee was due this month and will wait a few more months before applying again. Hopefully next time I will be worthy of receiving the real sign up bonus.

Anyone else not economically viable?

My application went into pending and I immediately called them up to inquire. They said I could be approved for a Platinum Plus with a credit line of $2500 and I told them no thank you, please cancel the application altogether. You have to call right away after applying.

I had been approved so many times before with no issue that I didn’t think this time was any different. I didn’t know there were two types of cards. Sloppy on my end.

Same thing happened to my mom. She’s not in the mikes game, shevjuat wanted that card so she could fly and visit me accross the country. She was approved for $4,800 credit limit. Apparently you get the Plus if you are approved for less than $5,000. Such shenanigans. Called to complain and they were basically useless.

So useless!

Same thing happened to me.. I had an old BOA account with a large CL. I was approved at 2k. Thankfully BOA agreed to close the account, remove the inquiry, and the account from my CR. I reduced my credit line on my old card and as instantly approved for the Signature AS card about 6 months later. BOA is strange – they didn’t give me the option of moving credit lines, just gave me the terrible card. It’s deceptive business practices in my opinion.

Completely deceptive and the issue is that I as a consumer protection attorney can’t do anything about it. Terms and conditions are terms and conditions.

Well actually as a lawyer you are uniquely situated to do something about it. Not all T&C are lawful. Maybe make a federal class action out of it. That would get them to change their tune pretty quickly!

class action isn’t as simple as waving a wand. not my specialty anyway

This is the reason why I never applied for this card. Some banks are tricky like that. So I just don’t ever apply when they say that the “visa signature is based on your credit worthiness” or “we reserve the right to give you a lower card with a lower sign up bonus”

The only reason I can’t complain is because I’ve had so many of these Alaska cards. That’s also the reason I was sloppy and didn’t read the fine print.

Same thing happened to me. I called to complain about the BOA non transparency and deceptive practices. Needless to say it when on deaf ears. No one at BOA cared. Hopefully, BOA will loose enough business from practices like this,

In the words of 2pac, some things will never change.

Same happened to me before so after approval i requested an increased credit limit, once it was approved I upgrade my card to the visa signature and received the 30k bonus. Not sure why they didnt automatically give me the higher credit limit in the first place.