Say what you want about credit card pushers, but I am fine seeing the constant stream of credit card offers in my Twitter feed. It inspires me to continue to churn, no matter how many times I have been rejected. Whether you purposefully don’t affiliate links to deny them money is up to you. I am not that spiteful.

Reading that the 80k Citi Premier offer was going away inspired me to apply again (see Citi Premier Rejection for Being Too Good at Life). While I would make good use of the 80k, I am equally as interested in having the ability to transfer my current balance of Thank You points to transfer partners, something that I cannot do with Citi Rewards+ card.

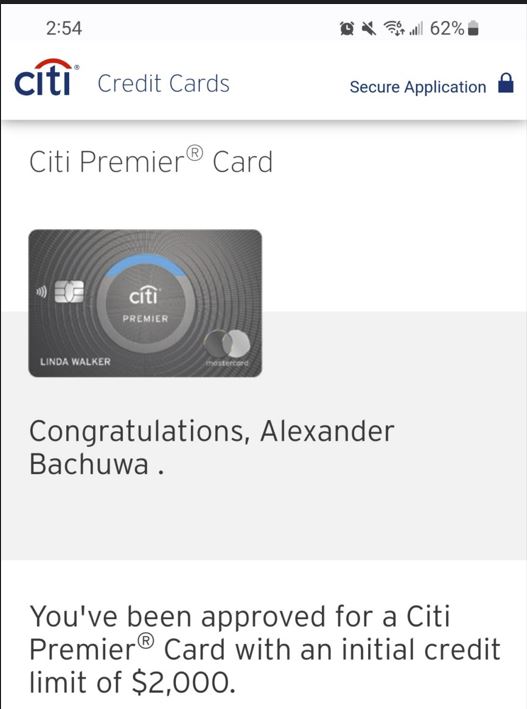

With low expectations, I hit submit and was surprised when I received the following:

I’m back in the game! I will have to call to transfer my abundance of credit from the + card so I can hit the minimum spend.

I was just rejected in December and called the reconsideration line and was told “no.” Did this also happen to you? If so, what do you think changed so that you were approved?

Nothing changed at all. I just randomly got approved. Maybe the AI was asleep

How much time elapsed between your last rejection and this acceptance I’m interested in trying again, but don’t want a hard pull to show on my credit report, since one of the reasons I was denied last month was too many pulls / credit cards. Any suggestions regarding how to avoid a hard pull / having this show up on my credit report?

August 25th 2022

Ms. TPOL got rejected like you. Same reason. Same amount of time has elapsed.

So Ms. TPOL was rejected in December and tried again today and was accepted?

As one of several folkse who several years’ ago was wrongly banned from applying for Citi cards yet still gets mailed invites to apply, is there evidence or hope that Citi might relax that ban?

All you can do is apply and see