I promise to take a break from the biggest news since I went from civilian to blogger, the release of the Chase Sapphire Reserve. Before I do, I want to share a funny anecdote about a friend of mine who has been participating in this game well before I went from Alexander to TPOL.

As is tradition, he and I were chatting on Facebook Messenger while he called recon. Out of superstition, I never tell people when I call recon and never celebrate my recon achievement until I hear ‘congratulations’. With him it’s the opposite:

I’m calling now.

I’m on hold.

Surely, I’m going to get rejected.

These fu*#e&s said no!

Following yesterday’s rejection, my friend decided (much like he did two years ago after another deval, after another MS loophole was closed) to quit the points hustle.

He promptly called Amex to put a stop to his other application. Keeping true to the play-by-play functionality of messenger he sent me the following string of message:

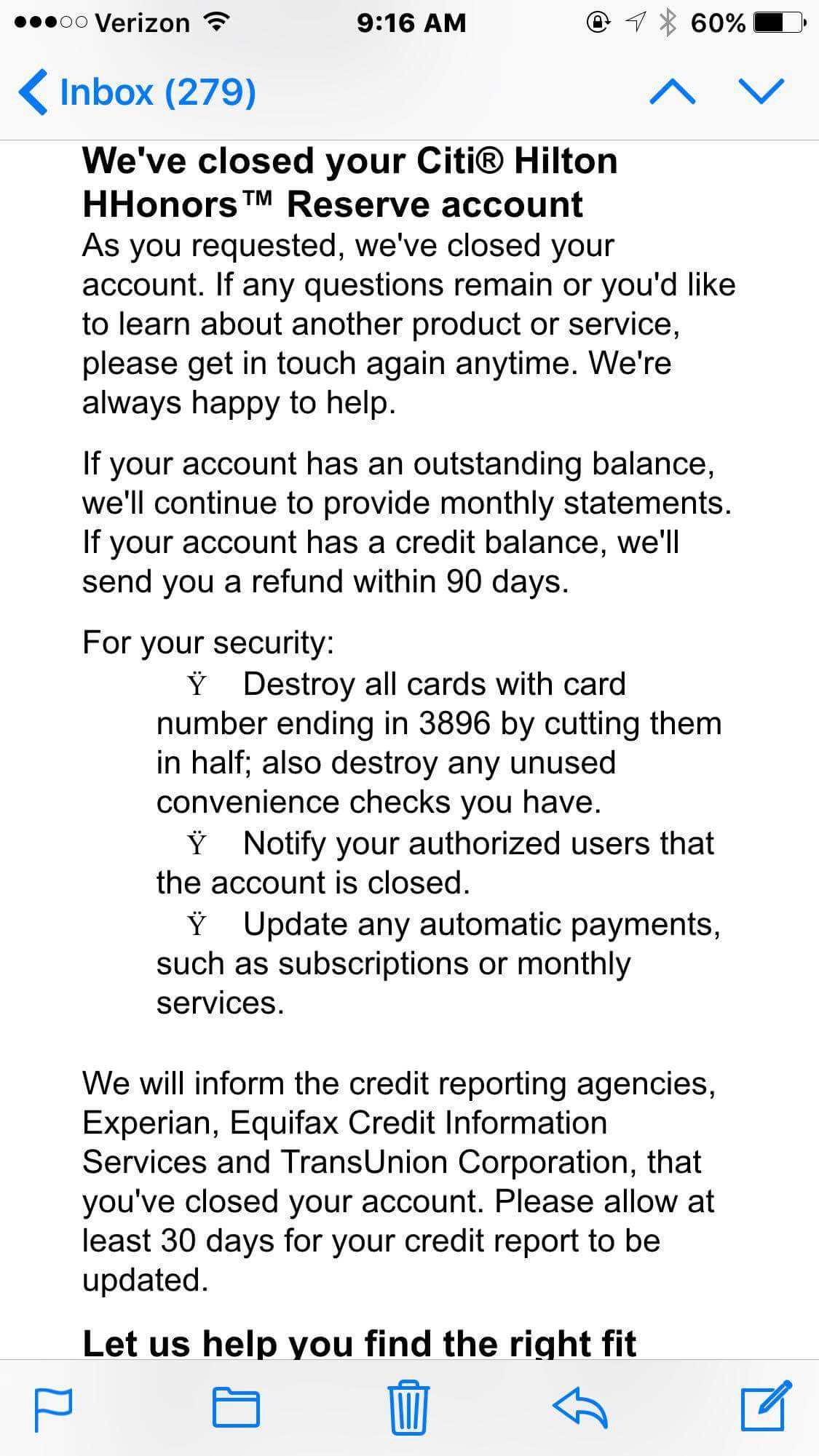

Citi Reserve: received the certs, burned the card tonight:

Duck the banks!

Close Chase Hyatt and stupid British too.

I’m angry.

IHG, Sapphire, Freedom, and Amex Everyday are keepers. The rest are toast.

Duckers.

Duck em all. Bastard banks.

I’ll be back in 24 months.

I will save my hatred and bitterness for Chase. I’m done with them. I’ll keep giving my business to other companies that want it.

Nothing will hurt chase more than you closing your asset accounts with them (savings, checking, business accounts, etc). Upon calling reconsideration yesterday, I told the rep that given that chase is not as willing to accept me as a new credit card customer (800+ score), my next step is to move all of my asset accounts to CITI (since they still will). Recon rep didn’t budge, but upon calling the local branch manager got involved and made a call somewhere. My application for the Reserve is now approved and the card is already shows under my accounts profile.

otoh, just tried to open a citigold account, and it’s literally taken them over 2 weeks to allow me to fund the account. i’ve received welcome letter + debit card, but they still wouldn’t allow me to fund. it’s WEIRDEST thing. it’s like they don’t want your money anymore?

if chase is sickening, BOA are cheats, and citi doesn’t want your money, where exactly does one go to bank?

Nice job! I don’t think I have the clout to pull that off, since I just have 3 credit cards with them, and only recently opened a chase checking account with $15k to get the $300 bonus and I had hoped could help getting CS(R). I hope more people threaten or actually do walk away from Chase, so we can get rid of these overly simplistic and poorly conceived policies. Until that day, goodbye Chase.

When I get back to NYC, I’ll go see my banker and try this approach. I like the tenacity.

Not taking this well…I’ll be back in less than a month!!

Chase is really getting on my last nerve. I’m at 4/24 with 3 AU accounts. I finally got Chase Recon to remove the AUs from the equation, but apparently one of the AUs (Costco Amex) is reporting as “closed/transferred” (to Citi) and did not show me as an AU so Chase believes it is a full account putting me at 4/24 (BTW they admitted the rule was 5). Anyway, I am in the process of getting all 3 AUs removed from my credit report so I can reapply. I’m also not happy with Amex for incorrectly reporting this account otherwise Chase would have approved me.

Once approved I am personally writing the VP of Chase Credit Card Services about this entire experience. Counting AUs is outrageous.

Soon in 2 years cards will be offering 1 million points as the inflationary aspect accelerates, and feeds into the devals we are treated like mice on a wheel or Jodie Foster in the accused