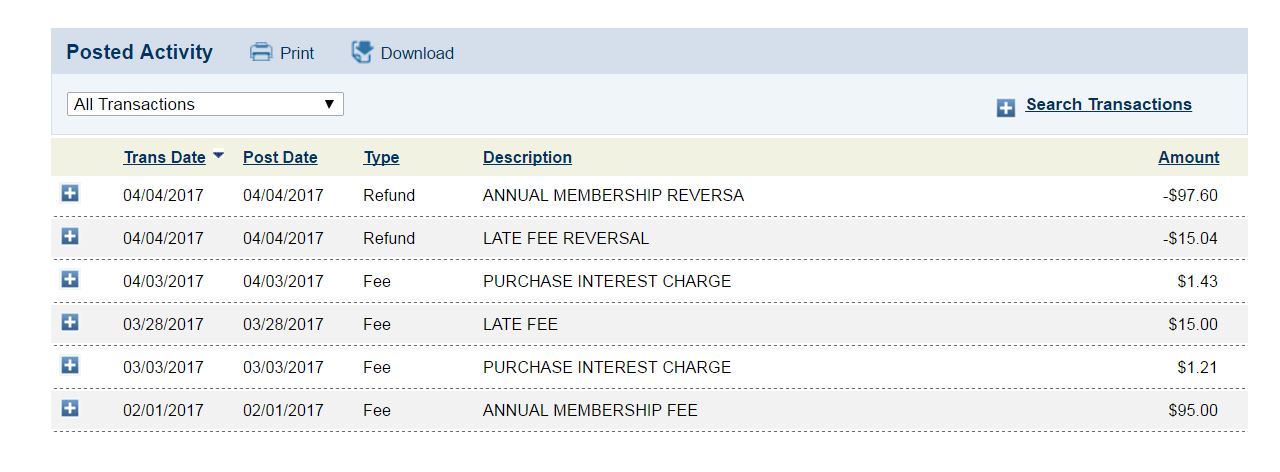

Retention offers on credit cards aren’t what they used to be. The effort and amount of stimulants needed to call a bank to try to pry a few points from their dead, cold hands is not worth the effort. As such, I usually put them off and off again. In this case, I had to deal with Chase and my United card. Life happened, my computer broke, and I didn’t bother calling in. I knew that I would get a late fee and also knew that Chase would waive the fee and interest because it would be silly to fine the customer and expect them to turn around and pay the annual fee.

As I was checking my Chase balance, I noticed that my United card was closed. Chase didn’t bother sending me notice and did it unilaterally. My credit score was not affected and technically they have the right to close the account since I was in default so I don’t think this is consumer arbitration worthy. Still, it seems a bit drastic to go this far on this one account. No other accounts were affected.

Definitely have a love/hate relationship with Chase…..they have done some bad things to me.

Interesting. Wonder if that goes on your chase “record”.

I’m having the problem of banks not denying me credit…26 open accounts including 5 from chase.

Good problem to have

https://youtu.be/yYzrSGRzttk

“the customer” should = customers

OR

“them” should = him or her

are you in agreement with pronoun agreement?

“because it would be silly to fine the ~~~customer~~~ and expect ~~~them~~~ to turn around and pay the annual fee.”

You have access!!