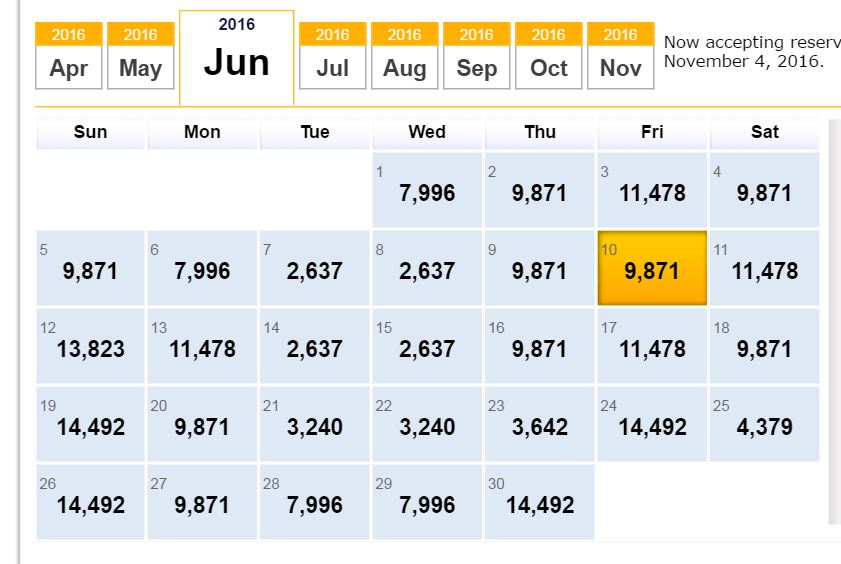

I don’t usually post about deals because everyone else does but I had to say something about this crazy Southwest sale. Initially, I thought it was some sort of mistake because I haven’t seen these rates since the good old days of PHX-LAS circa 2008.

The Best Bank for Online Banking

A reader asked me what bank I thought was the best for online banking if “Wells Fargo is so antiquated.” Wells Fargo may be America’s biggest bank by size but their online platform, credit card approval process, and commercials make them look like they are a local credit union, except for the customer service of course, for which they are dreadful.

Here are the following banks/credit card companies that TPOL uses to get down and dirty in the points game: Chase, Bank of America, American Express, Barclays, Discover, and US Bank. I use Chuck for international checking because there are no ATM fees but that’s not part of this discussion because I do not have a credit card through them.

This list focuses on ease of use for paying bills and navigating the website. It is not about the actual credit cards that are offered.

Here is the list from worst to best banks for online banking:

7. Bank of America: BOA sucks from top to bottom. Most of us only use BOA because we love the state of Palin or because they offer insane balance transfer options where the cost of capital is virtually nonexistent. But, once you do use your Alaska points to fly from Anchorage to Russia which you can see from your house, you will rarely visit the BOA website. That’s a good thing because setting up bill pay is a pain and the online chat always leads to the same advice, “You’ll have to call our customer care for that.” The reason I hate BOA the most is because they won’t let me change my bill due date to the 28th. This magical day that I set all my bills to be paid is not allowed as the statement date for some silly reason. As a result, I have to keep an extra red tab in my Excel spreadsheet so I don’t miss a payment.

6. US Bank: Luckily post Club Carlson devaluation, I don’t have to go to US Bank’s website either. Why do I hate US Bank too? Because they list my business card balance under accounts but this amount is not always accurate. I have to log in separately to my business account to find that balance. By the way, where the hell are my anniversary points? I updated AwardWallet the other day and I still only received them for one of my CC accounts. I wanna talk to the President! I know that most banks have a separate login for business cards but this is the only one I know of that posts the right card with the wrong balance.

5. Citi: Citi’s website is a piece of poop. I’m not sure if it is a cache issue but more often than not I have to log into my Citi account by using private browsing otherwise I will get an error. Even after I am logged in, there is still error after error for ‘Forbidden behavior’ and not the kind that one stumbles upon in a private browser forum.

The good thing about Citi is that you can change your due date very easily online, the chat is decently helpful, and the option to refund a credit balance can be requested via secure message.

The bad thing about Citi beyond errors is the need for three accounts: one for normal Citi cards, one for Hilton Citi cards, and one for business Citi. To make life ‘easier’ I even had a fourth Citi account when I botched the Citi Gold checking account. This turned out to be a wise move because closing Ms TPOL’s Citi gold account which was linked to her personal account led to all of her online accounts being deleted.

Don’t even get me started on the No ThankYou program page which has nothing on Chase’s UR portal.

4. Barclays: Barclays has a great secure message system and a bright display that shows you when your bill is due. In the glory days of the Arrival plus card, redeeming points was also very easy. I do not like how I have to click off of one card to get the last 4 digits of the card that I am not viewing.

3. Discover: Discover is number three because it takes up the least amount of my time. I log in, I see a zero balance, and I leave. If somehow I have a balance and I forget to pay it, Discover treats me like me and waives the late fee.

2. Chase: I love Chase. All of my accounts including my checking account are available on one page for which I enjoy scrolling endlessly and seeing the list of cards and the pretty logos next to them. All of my due dates are the 28th and the UR balance is easily accessible. When I pay my credit card bill, the checking account balance is automatically updated to reflect this even if the payment has not gone through. To that end, if there is a mistake and I need to cancel a payment, Chase readily allows me to do so while Citi often results in an error.

I do not like how long it takes for my Ink card to update from one cycle to the next. The new points balances usually come out around the 3rd of the month but the Ink which has the same due date as the other takes until the 6th or 7th. Chase should have a chat but I forgive them because of the promptness and helpfulness of their secure message center.

1. American Express: If the world was run by Amex, life would be better. The website is as close to perfect as perfect gets. The menu of the cards is crisp and clear. I see right away my balance due and they spare me the math of trying to figure out how much my statement balance is by showing that I still have X amount left to pay this cycle in the event that I made a prior payment .

The online chat is also very helpful and the MR portal is easy to use. One thing that is annoying is transferring a credit balance from one card to another. This literally takes days to do and many times I have to request it to be done again. In terms of disputing bad charges, Amex makes it easy as well. Thank you Amex for making paying and managing bills enjoyable.

There you have it, the best platforms for online banking.

And now this:

Keep Vs. Cancel: Chase 2016

This is my favorite type of post. The Keep Vs. Cancel is always a good time. If Chase’s 5/24 rule truly comes into being then these will be the cards that remain in my Chase portfolio.

- Slate: Keep because it is one of my oldest cards with Chase.

- Freedom: Keep for the same reason.

- Sapphire: Keep because this is the free version that still has plenty of great benefits.

- Marriott: I just received this card and paid the annual fee so obviously I am going to keep it this year. I will hold onto it next year because I want to see what happens with SPG.

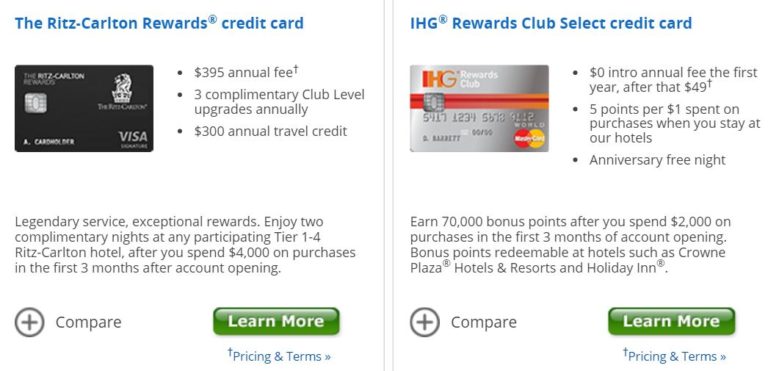

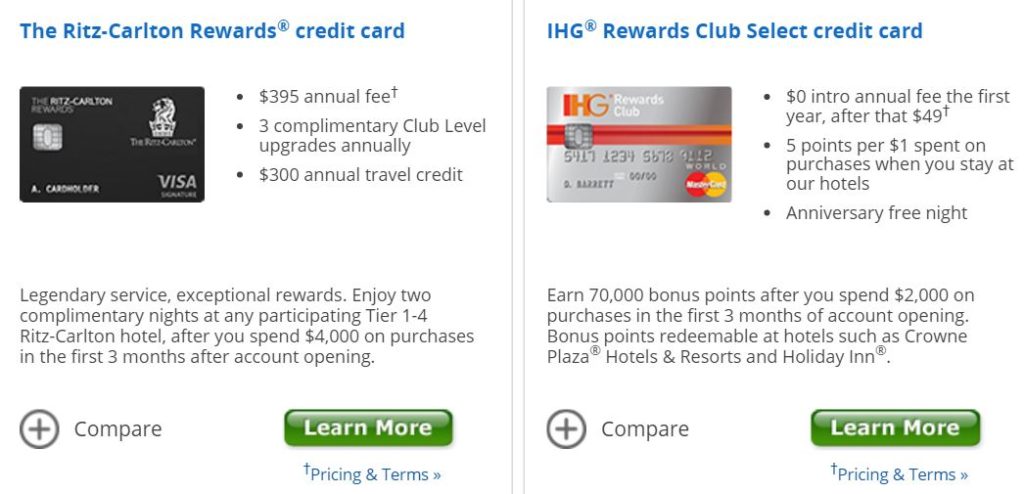

- IHG: I am keeping this card indefinitely because of the free annual night.

- Hyatt: I just was approved again for this card and will be keeping it for the foreseeable future because of the free annual night that trumps the annual fee.

- INK: I’ve never been able to escape the annual fee but this is my most consistent method for getting URs. I’m keeping this for life.

- United: This card is also new for 2016. I would like to keep it because of the free luggage and my proximity to EWR but that’s a decision for 2017.

- British: Cancel in September. I’m still 10k short of receiving the last 25k Avios points and need to figure out how I’m going to do that.

Chase Recon: How to Get It Done

I had the Hyatt card then cancelled it in order to get the Marriott with the hopes that I could get the Hyatt card again before the mythical 5/24 rule took over. I applied and an hour later was still on hold with Chase. This was the longest recon call next to my most resilient recon call with Wells Fargo. The questions kept coming one after another: Why do you have 12 new cards on your account? Are you in financial distress? Why do you have so much credit with Chase? Why do you want more credit? Why do you have cards with Chase that are open that you do not use? Clearly, this representative was meticulous so I explained everything in a thorough, candid way. Let’s take one question at a time:

- Why do you have so much credit with Chase? I’ve been banking with Chase since they were Bank One and one of my first credit cards was with Chase. Over the years I have built a strong relationship with Chase and have never been late on a payment or carried a balance.

- Why do you have cards with Chase that are open that you do not use? I know I have cards like the Slate that I do not use but I was told that keeping these older cards open raises my credit score by elongating my credit history.

- Why do you have 12 new cards on your account? As a business traveler, I’m almost forced to have so many cards and I am almost forced to keep up with the new ones in order to save money. I know that on the surface that may not make sense but let me give you some examples. I’m in New York now so I fly United. If I don’t have the United card and need to check my golf clubs then I have to pay for baggage fees. I used to stay at SPG hotels the most but now with the merger I am switching to Marriott and that card may come in handy. The same is true of the Hyatt card which gives me late checkout and other great benefits that I would not receive if I didn’t have it.

- Are you in financial distress? The only stress I have is knowing that I have to spend $1 on this card to get this point and $1 on that card to get that point.

- Why do you want more credit? I certainly do not want more credit. My reason for opening this card is for the benefits alone. I’ll gladly shift credit from one card to another.

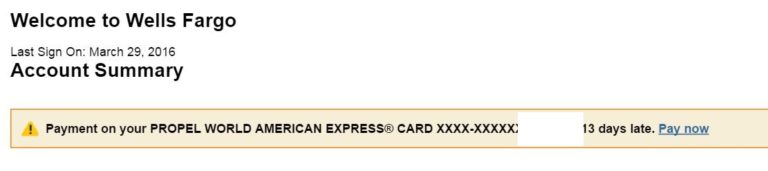

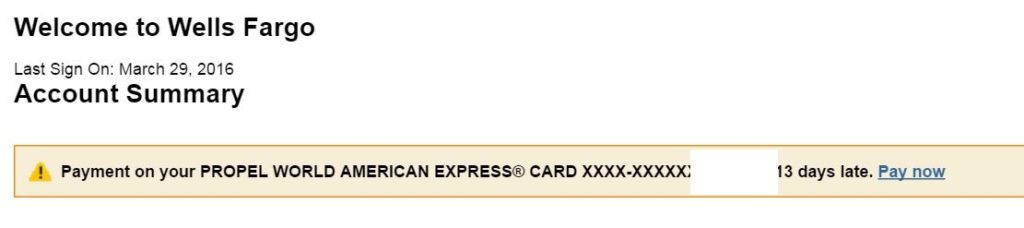

Late CC Payment: A Lesson in Checking All Cards

When you’re a master churner, you may find that you have more credit cards than friends. This could be due to one of the following:

- a) You are an anti-social nerd that spends all of your time hoarding points and updating your Excel spreadsheet.

- b) You posted too many pics from flying Etihad that nobody likes you anymore.

- c) You have forty credit cards and you don’t have time for that many friends.

- d) All of the above.

MetroCard Misery: TPOL Supports Hillary

Alexander the private citizen is an undecided voter. The candidate pool leaves much to be desired. TPOL the blogger is a single issue voter. He, as a New York transplant, believes that in comprehensive subway reform. For that reason, and that reason alone, TPOL is supporting Hillary in her time of distress. If you haven’t seen the clip, presidential hopeful Hillary Clinton, had trouble swiping her MetroCard in the Bronx. Political pundits have pounced on Hillary’s inability to maneuver the metro as a sign that she is disconnected from the common people. This is only half-true. The reality is that the MetroCard is a flimsy piece of junk that occasionally doesn’t swipe properly. It is just one of many issues that face New York’s transit system. Hillary’s campaign advisers should have anticipated that this could happen. A quick practice session would have served her well. Obviously, Hillary doesn’t ride the subway and this stunt backfired but it’s not as big a deal as is being made by the media. The real issue, the archaic metro system, should be the story.

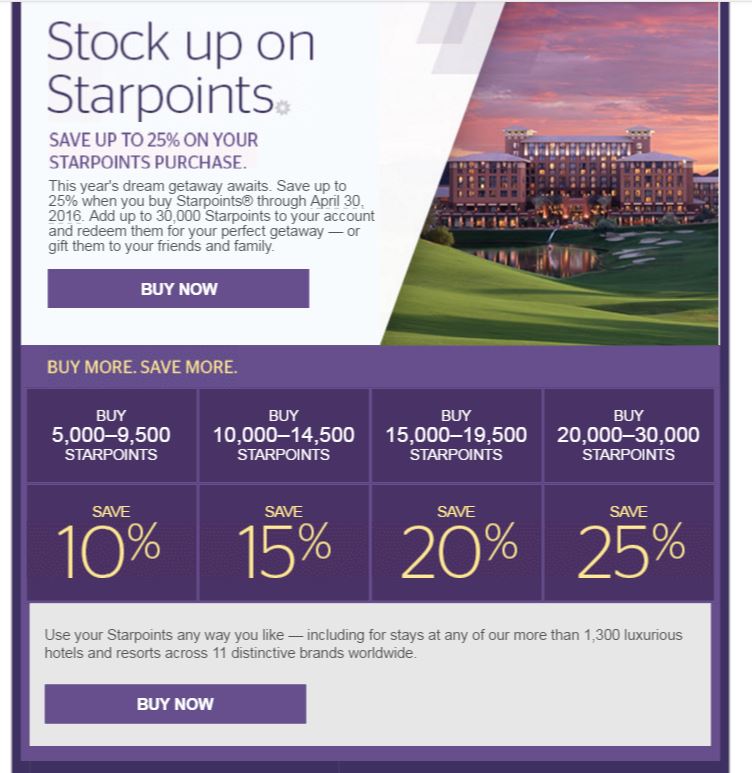

Buy SPG Points? Fool Me Once…

I rarely buy points and when I do I prefer Dos Equis or ones that don’t devalue. SPG has a promotion through the end of April that I will not be participating in. SPG is my favorite program (for now) but I see no value in buying points when the future of the program is very much in jeopardy. Add in what happened with Alaska killing of Shower Class and you’d have to have a great reason to jump in on this deal.

Anyone risk loving enough to do this?

Disqus Is Dead: An Invite to Trolls

You asked. I listened. Disqus is no longer the weapon of choice for TPOL’s comments. I’ve gone back to WordPress’ old papyrus platform where you can put in a fake email and talk all the ish you want to satisfy your little troll heart. Or you can login with your Twitter or Facebook. This revelation came as a result of zero comments on my funny Ping Pong Show post where TPOL is the #1 image result. Surely someone has something to say.

The choice is yours America! Anonymous angry Trump troll comments or the other not so great alternatives.