I’m back from my #NoCollusion tour where I visited

- Spain’s Iberia Lounge

- Israel (and the lovely people at immigration)

- Poland

- Macedonia

- Albania

- Greece

- Slovenia

- Switzerland

- Luxemburg

- Portugal

Before traveling I try to find flights on the best metal for as cheap as possible and to use my points to stay at top end hotels for next to nothing, all in an effort to be as frugal as possible. This frugality ends as soon as the vacation begins. Unlike many bloggers who won’t spend $1 unless they can MS $1.25 before they leave, I’m not annoyingly cheap. Those people are the same ones who will go to Maldives for free but not splurge for the overwater bungalow (see Should I Pay for an Overwater Bungalow?). That is no way to live, and I’ll be the first to judge.

I do the exact opposite. I paid the exorbitant $620 a night upgrade charge at the Conrad Maldives. I’ll go out for dinner and drinks and order everything on the menu (see Where to Eat Steak Johannesburg: Grillhouse Is A Great Choice). I’ll pay $300 to jump off a bridge in Victoria Falls. It’s not because I’m a millionaire, nor is it because I enjoy burning money. I certainly do not (see TPOL’s Guide to Bargaining Abroad, see Free Breakfast?! The InterContinental Bora Bora Says No). I spend like I have Arab money because the point of traveling is to do and experience what you would not at home.

Having said that, nothing gives me more anxiety than swiping my card too many times. Freestyle spending like binge eating can add up quickly. How did I spend 5k in a week when I didn’t even buy any souvenirs? The way I avoid sticker shock is by using the HomeBudget app (available for Android and iPhone) to track my purchases while I’m away. I use it religiously when I am at home and try to remain true to it when I’m on the road.

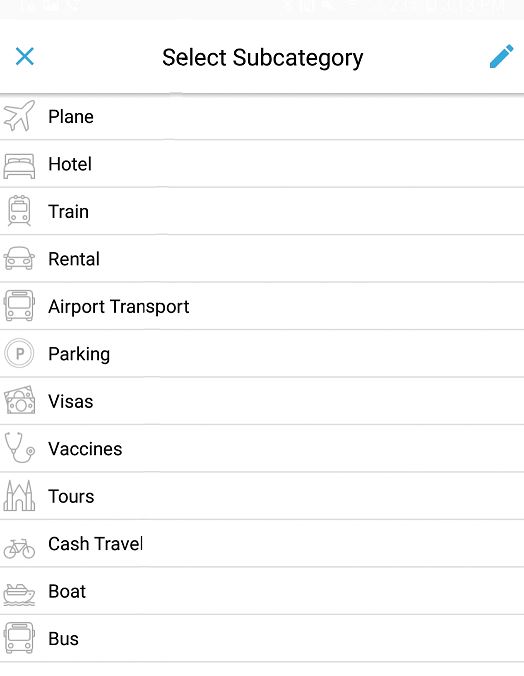

I have a category for everything from Restaurants to Sports to Annual Fees. Within those categories, I have even more subcategories. For example, these are the subcategories for Travel.

‘Cash Travel’ is a ‘reconcile’ subcategory. It is for those euros that fall out of my pocket, or the time I ordered too many shots and did not have the presence of mind to input it into my phone.

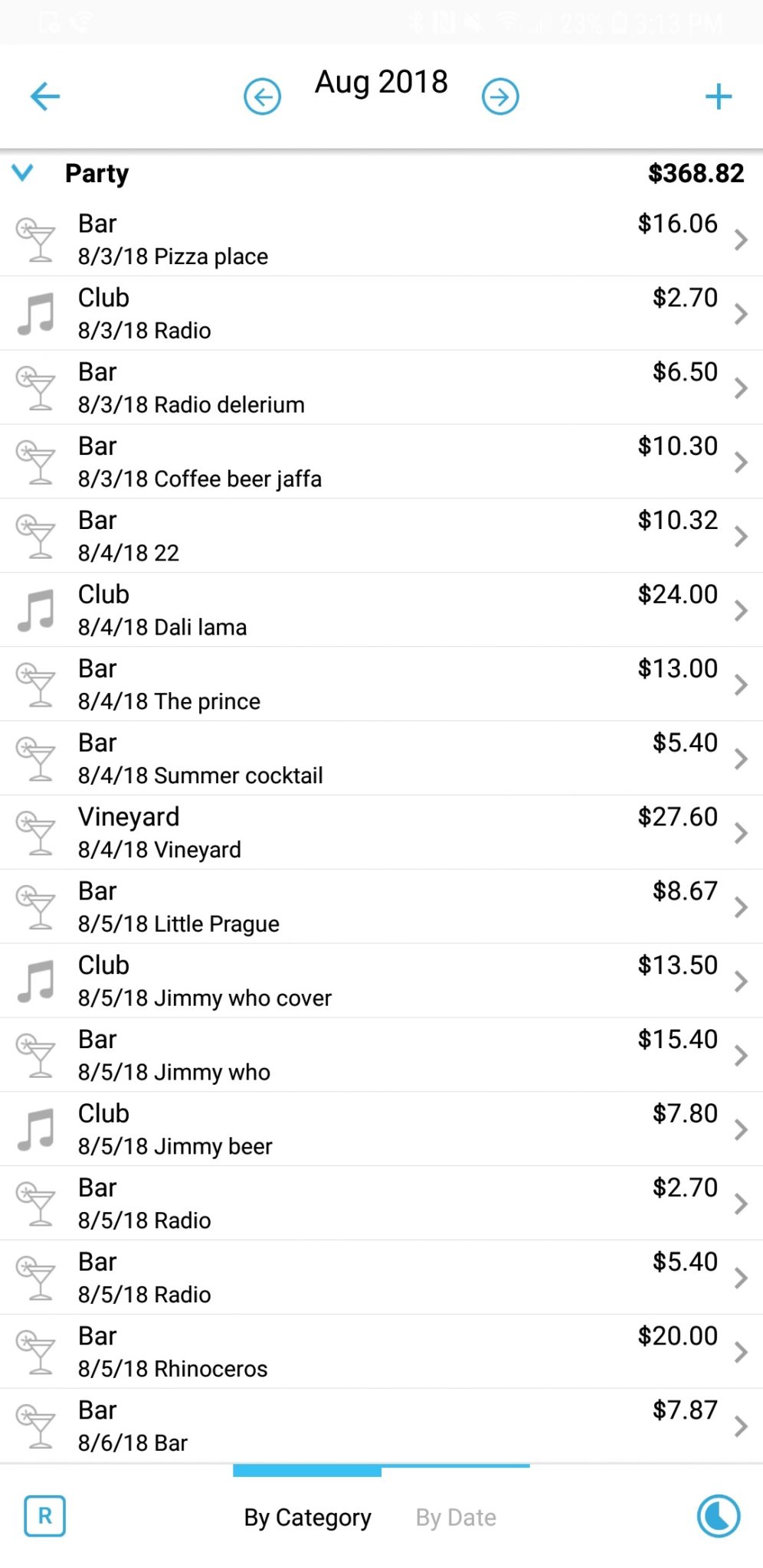

Here is a list of my Party expenditures when I was in Tel Aviv. Like a nerd, I input the charges in real-time. ‘Pizza place’ is the bar on Dizengoff Street. And Radio is one of the best discos in the world. I’m still trying to recall what Rhinoceros is. There is a place available for notes but adding that when you’re trying to party kills the mood.

Although I try to record everything as I go, I don’t place a limit for what I can spend. An expensive dinner one day does not mean McDonald’s the next, unless it’s my birthday and I’m in Paris (see McDonald’s Paris: Fine French Cuisine on My Birthday). In fact, I purposefully do not look at how much I spend. That pleasure is reserved for when I’m back at home. While my behavior might appear to be reckless, I’ve learned two things from this OCD process: 1) I’m not a cheapskate points traveler. 2) Despite ignoring the grand total of how much I have spent, the daily input of expenditures has kept me from going too wild because I am conscious of each time I purchase anything.

What about you? Are you a cheap traveler? Do you use a budget app?

TPOL’s TIP: A cool feature of HomeBudget is that your spouse can have the app as well, and it can be linked to one account. Budgeting is fun for the whole family!

I’m somewhat cheap, because I try to manage to travel a couple of months a year, which can cost. I don’t use an app, and my budgeting is pretty rudimentary, but there are some things I do to try to save where possible:

Pick lower cost places to vacation. Staying in Bali or Budapest is lots cheaper than London or Copenhagen.

Bring duty free liquor. This helps a lot when visiting high tax destinations.

Stay at an all-inclusive. This makes budgeting easier. The best places cost wise are bookable on points.

Stay at hotels where status has cost saving benefits. Free breakfast and/or club lounge access can save lots of money on food and drink.

The above give me freedom to travel more and watch my spending less when I go somewhere. My wife and I always have one really nice dinner each trip, where cost is pretty much not a factor. Things like that make a trip even more special. We can do that by saving elsewhere.

Of course, it still has to work for each person’s budget. I’d love to have champagne for breakfast but there is opportunity cost. I agree save here to do more there. But some people act like I did when I went to Tahiti and brought beef jerky because I refuse to be ripped off because I’m on an island. The difference is they do it all the time. Might as well stay home.

And for sure, no London when there’s Budapest. The worst is Italy, no value.

What exact app are you using for android, there seems to be a few.

Literally called Home Budget with sync